Investment Strategy

We deploy a three-prong strategy to unlock value: Fix & Flip / Hold (50–70% of ARV; 6–8 months; hold when rental targets qualify); SFR Development (BTR/BTS; 24–36 months; ~20% IRR target); MFR Development (garden/mid-rise ≤50 units; 36–48 months; incentive jurisdictions).

Acquire & Improve

Acquire at 50–70% of ARV, renovate, and sell or rent within 6–8 months. Hold when rental returns meet thresholds.

Capital Efficiency

Quick recycling of capital funds development pipeline; portfolio aims for balanced short & long horizons.

Risk Controls

Disciplined acquisition screen; contingencies and construction oversight minimize variance.

BTR/BTS

24–36 month cycle from acquisition to lease-up/sale; refinance stabilized assets or sell targeting ~20% IRR.

Escrow Strategy

Use longer escrows during design/entitlements to reduce initial outlay and protect downside.

Scale Rentals

Garden/mid-rise up to ~50 units (36–48 months). Prioritize zoning incentives and bonus programs in high-need cities.

Underwriting

Target rental performance aligned with Fund return thresholds; systematic review at each phase gate.

By the Numbers (7-Year Projections)

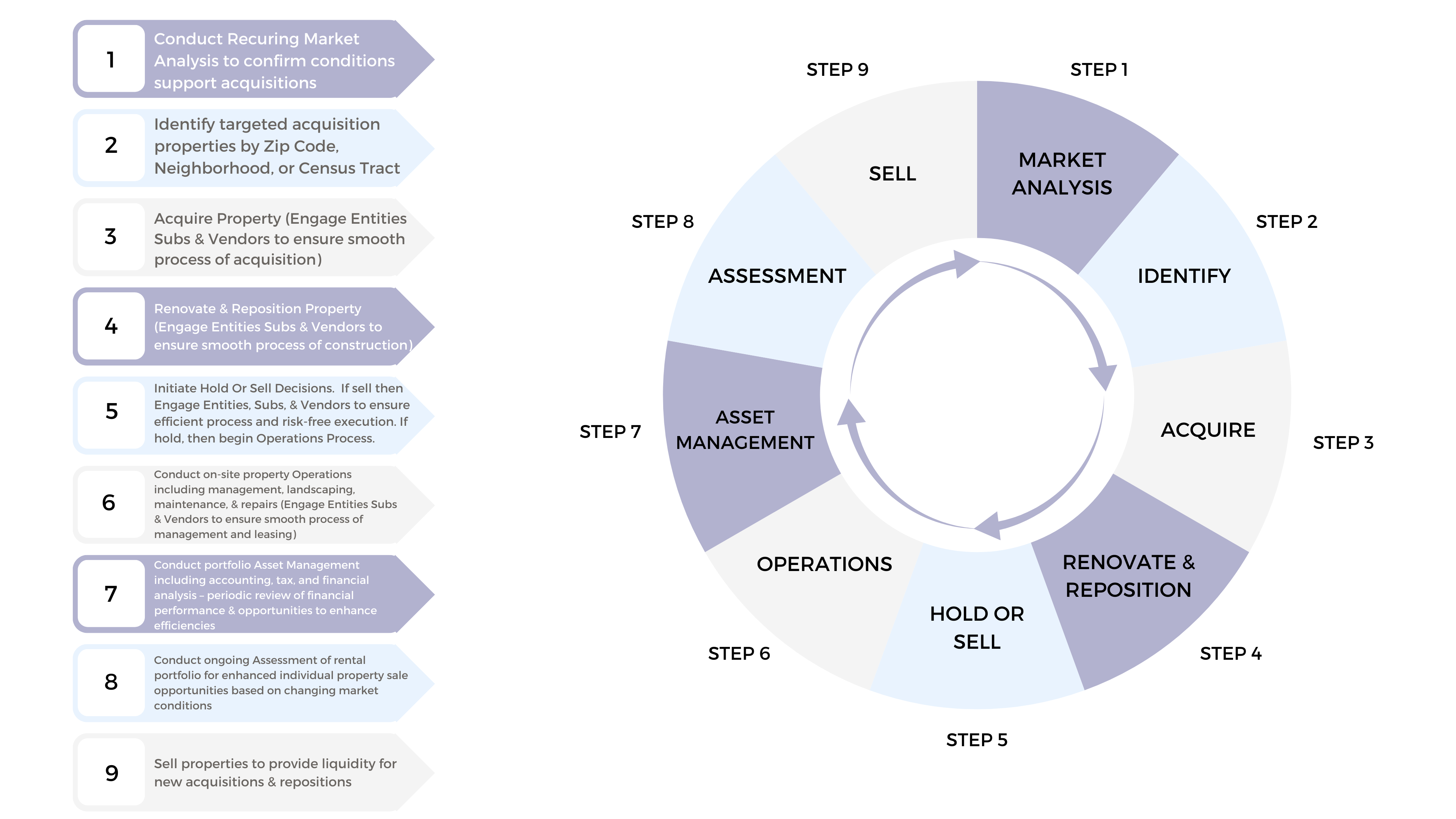

Lifecycle